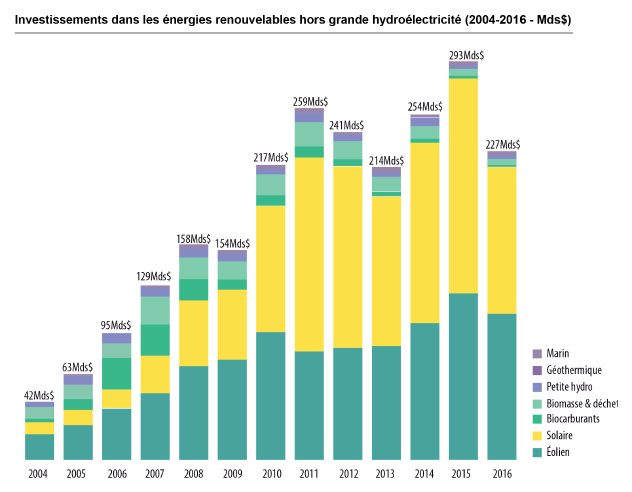

As the world seemed poised to embrace a future powered by renewable energies, an unexpected wave of reservations has emerged within financial circles. Some investment funds, once champions of clean energy, are now turning towards fossil fuels, prompting questions about this surprising shift. Concerns related to short-term investment return efficiency, the industrial dominance of certain global powers, and unresolved technological issues contribute to this distrust. Do these investors, known for their flair and risk management, see in this hesitation a fleeting opportunity or a deeper strategic change? Recent figures show a trend of skepticism, but every bet is also a calculated risk, even in the most promising sectors.

Recently, an analysis revealed that hedge funds are massively investing in fossil fuels while betting against renewable energies. This trend is partly due to the slow returns expected from green investments. Indices related to renewable energies, such as the S&P Global Clean Energy, have lost a significant part of their value, while oil indices have seen a notable increase.

In the solar sector, concerns are predominant due to China’s dominant position in the market, making it difficult for Western competitors to break through. Furthermore, growing industries such as electric vehicles and hydrogen face similar obstacles, with a lack of concrete demand and higher costs for producing green hydrogen.

This situation reinforces investors’ fears and leads to a decline in investments in these sectors for some. However, some American players, like First Solar, show that opportunities exist without dependence on Chinese technology.

negative perception of financial returns

Savvy investors see the renewable energy sector as an uncertain bet. The recent drop of nearly 60% in the S&P Global Clean Energy index sharply contrasts with the rise of the S&P Global Oil and S&P 500 indices. This dynamic raises doubts among fund managers regarding the ability of green investments to generate returns similar to fossil fuels. The scale of investments required and the political and economic uncertainties reinforce this skeptical sentiment.

subsidy and geographical dependence

China’s dominance in the solar sector worries many Western investors. Indeed, the manufacturing of the overwhelming majority of solar panels is currently concentrated in China, making competition difficult for Western companies. This geographical dependence, coupled with current political turmoil, urges investors to reconsider their portfolios. Protectionist policies, such as those considering taxes on Chinese imports, also do not facilitate investment in this sector.

market variability and associated risks

The variability of the renewable energy market is a key factor driving investors towards other sectors. Changes in government policies and fluctuations in interest rates create an uncertain environment. For instance, in the hydrogen sector, the cost of green production remains significantly higher than that of gray hydrogen. Moreover, the lack of infrastructure and demand hampers expansion. As a result, investors tend to lean towards assets perceived as more stable in the short term.

? Pour les investisseurs à la recherche de revenus passifs, les actions à dividende mensuel peuvent représenter une source de revenus stables.

— Le média de l'investisseur (@le_investisseur) September 28, 2024

Découvrez le top 15 des actions à dividende mensuel du moment ?https://t.co/RKzmdnEidG

Articles similaires

Thank you!

We will contact you soon.