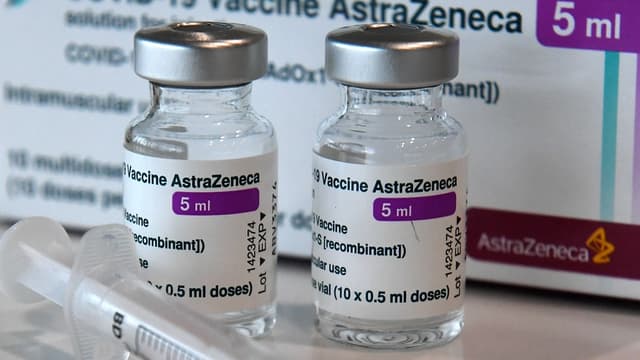

AstraZeneca, the British pharmaceutical giant, is considering the possibility of job reductions in the United Kingdom. This decision would be made if the government imposes a global tax on profits derived from the genetic codes of nature. The issue of Digital Sequence Information is at the heart of the debates, as it plays an increasing role in the development of new medications. Discussions on the fair distribution of profits from biodiversity are taking place at the Cop16 biodiversity meeting in Cali, Colombia. Biodiversity-rich countries, often economically disadvantaged, are demanding fair compensation for the free use of these genetic resources by multinational companies.

The pharmaceutical company AstraZeneca has expressed its concern regarding the potential imposition by the government of a global tax on profits derived from the genetic codes of nature. This measure would aim to share profits from digital sequences of biodiversity used in the development of new medications. If implemented, AstraZeneca could be forced to reduce jobs in the United Kingdom, particularly in the northwest of England. These statements come amid intense lobbying by the pharmaceutical industry, as discussions on this topic are ongoing at the Cop16 biodiversity summit in Colombia.

context of the tax on medicines related to biodiversity

The main issue revolves around Digital Sequence Information (DSI), which refers to digital information on genetic sequences. Pharmaceutical companies such as AstraZeneca use it for free to design new medications. Currently, a proposal for a global tax could force these companies to share a portion of their profits derived from genetic biodiversity, often stemming from less developed countries. These biodiversity-rich nations argue that such free use is a form of “biopiracy”.

potential impact on employment in the united kingdom

If such a tax is implemented, AstraZeneca has hinted at the possibility of job reductions at its UK site. The laboratory, which has already announced a major investment in the United Kingdom, fears that this tax could weaken its competitiveness, especially against countries like the United States that would not be subject to similar restrictions. Such a scenario could also impact vital public health research efforts in the UK.

reactions from the pharmaceutical industry

Pharmaceutical companies, including AstraZeneca, have expressed their opposition to this tax proposal. They believe it could hinder innovation and economic growth while jeopardizing the conservation of natural resources. For them, any initiative should promote natural preservation without harming scientific advancement. AstraZeneca clarified that none of its representatives have directly threatened to reduce their operations, although concerns remain.

? Ça ne va pas fort pour les usines de batteries auto en Europe.

— Challenges (@Challenges) September 11, 2024

Le gouvernement italien convoque les représentants du groupe franco-allemand ACC, alors que le spécialiste suédois Northvolt annonce des réductions d'emplois.

➡️ https://t.co/2YFBzqwkJAhttps://t.co/2YFBzqwkJA

Articles similaires

Thank you!

We will contact you soon.