In an energy universe undergoing significant changes, the second quarter provided a captivating view of the performance of companies involved in renewable energies. In particular, SolarEdge (NASDAQ:SEDG), a pioneer in solar innovation, is under the spotlight, compared with its rivals who are also shaping this dynamic market. Amid economic influences and increasing regulations against “dirty” energy sources, these companies adapt and seek to establish themselves through their capacity for innovation. The recent modification of interest rates by the Federal Reserve also plays a crucial role, acting as a favorable or adverse wind in this booming sector.

The renewable energy industry is experiencing a rapidly changing momentum, driven by the transition to green energy sources. This evolution impacts the performance of companies, particularly those operating in the solar sector. Among them, SolarEdge Technologies (NASDAQ:SEDG), which specializes in enhancing solar panel efficiency, stands out prominently.

During the second quarter, SolarEdge reported revenue of $265.4 million, despite a decrease of 73.2% compared to the previous year. However, this result surpassed analysts’ expectations by 1.1%. Nevertheless, concerns remain: the revenue forecasts for the next quarter did not meet market expectations, leading to a drop of 22.4% in the stock.

In the same sector, other companies such as Shoals Technologies (NASDAQ:SHLS) and NuScale (NYSE:SMR) exhibited varied performances. Shoals recorded a 16.7% decrease in revenue to $99.25 million, but exceeded analysts’ forecasts. NuScale, on the other hand, showed a revenue decline of 83.3%, reaching a low of $967,000. Notably, despite this underperformance, NuScale’s stock rose by 59.4%.

In summary, while SolarEdge strives to maintain its position in a rapidly changing market, the renewable energy sector is generating growing interest due to its innovations and major economic issues.

SolarEdge’s performance and its sector competitors

The second quarter was marked by the publication of financial results from renewable energy companies, attracting particular attention to SolarEdge (NASDAQ:SEDG). With revenues reaching $265.4 million, although slightly above analysts’ forecasts, the company observed a significant decrease of 73.2% compared to the previous year, a concerning figure for some investors. The renewable energy industry is undergoing transformation, and those innovating the fastest seem to gain the advantage in this green race. The impact of increasing environmental regulations and fluctuations in interest rates adds challenges for these companies seeking to transform traditional energy production methods.

SolarEdge’s strategic positioning

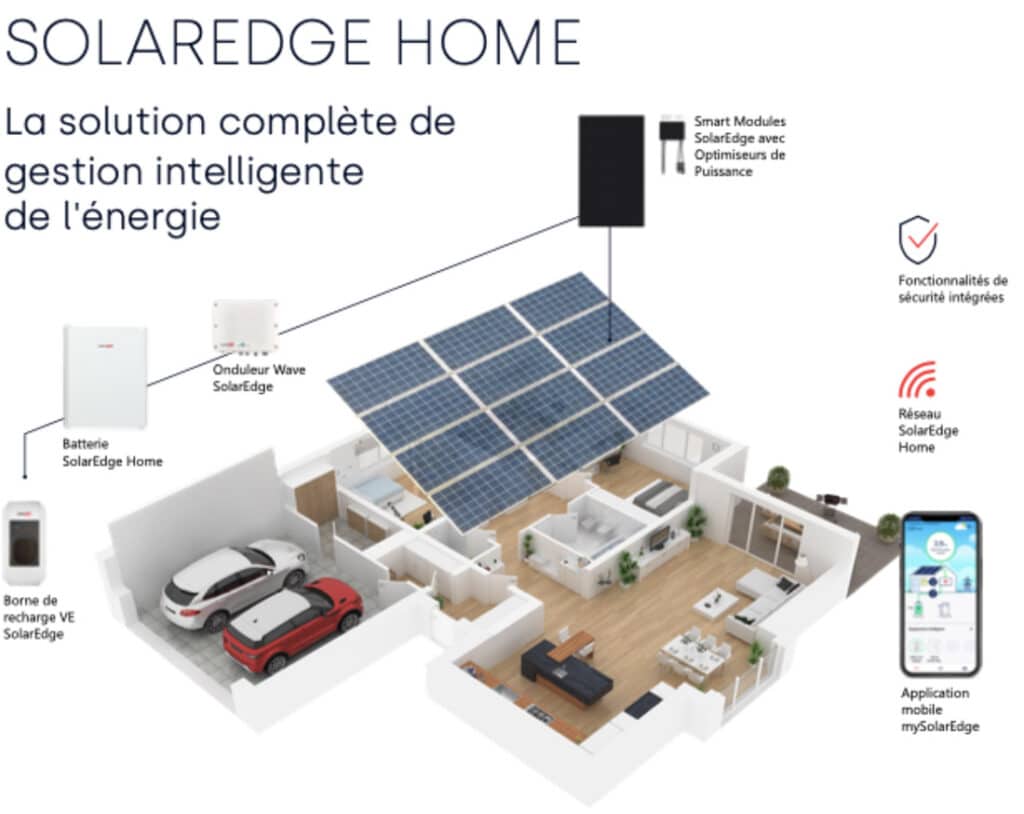

Faced with rising competition, SolarEdge (SEDG) seeks to optimize its market position with technologies allowing for increased solar panel efficiency. However, its revenue guidance for the next quarter remains below analysts’ expectations, creating some concern for the near future. A constant innovation strategy is crucial in an environment where regulatory changes regarding more polluting energy sources dictate developments. SolarEdge may also explore further diversification in its operations to counter the impact of recent revenue declines.

Increased competition in the renewable energy field

Competing companies, such as Shoals (NASDAQ:SHLS) and Nextracker (NASDAQ:NXT), have reported varied financial results, adding a layer of competition in this dynamic market. While Shoals managed to exceed analysts’ forecasts despite a slight 16.7% decrease in its revenue, Nextracker demonstrated a notable increase of 50.1% compared to the previous year. This diversity in financial performance highlights the multiple challenges and opportunities present in the renewable energy sector. Companies that quickly adapt to market fluctuations and adjust their strategies to meet technological and regulatory demands have a clear advantage in capitalizing on the global energy transition.

Marine Le Pen: "Je veux arrêter les énergies renouvelables, parce que ce que vous appelez énergie renouvelable n'est pas propre et n'est pas renouvelable" pic.twitter.com/1sIAZqDCPi

— BFMTV (@BFMTV) June 5, 2024

Articles similaires

Thank you!

We will contact you soon.